pay indiana state estimated taxes online

If the amount on line I also includes estimated county tax enter the portion on. A copy of your bill with your Letter ID.

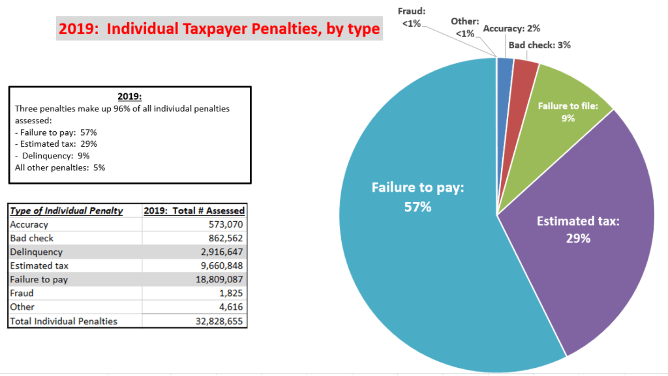

Do S And Don Ts When Requesting Irs Penalty Abatement For Failure To File Or Pay Penalties Jackson Hewitt

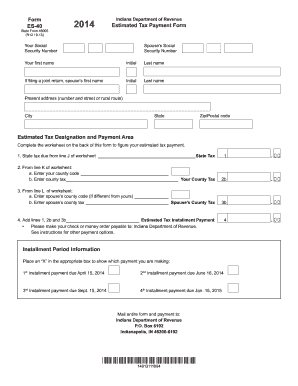

Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

. The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan. Find Indiana tax forms. Use a pre-printed proof of estimated taxes issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated taxes.

Access INTIME at intimedoringov. Check status of payment. The Indiana income tax system is a pay-as-you-go system.

Know when I will receive my tax refund. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Michigan Estimated Income Tax for Individuals MI-1040ES Michigan Individual Income Tax Extension Form 4.

Pay by check or money order. You will receive a notification from PayConnexion and your bank will. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

If the amount on line I also includes estimated county tax enter the portion on. To make an individual estimated tax payment electronically without logging in to INTIME. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

You must make estimated payments if the expected tax due on your taxable income not subject to withholding is more. Tax identification TID or social security number SSN. Cookies are required to use this site.

Income and Fiduciary estimated tax payments. This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. There are three types of bills.

Payment can be made by credit or debit card Discover Visa MasterCard or American Express using the departments Online Services Guest Payment Service directly visiting ACI. Make a payment plan payment. Many taxpayers have enough taxes withheld from their income throughout the year to cover their year-end total.

Find Indiana tax forms. Use form ES-40 to pay Indiana state estimated. Estimated payments may also be made online through Indianas INTIME website.

Pay your Indiana tax return. If the amount on line I also includes estimated county tax enter the portion on. Most popular FAQs for Pay Indiana State Taxes Online Before you pay.

You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. Pay Your Property Taxes. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME.

Know when I will receive my tax refund. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Search by address Search by parcel number.

Indy Free Tax Prep is a network of Volunteer Income Tax Assistance VITA sites provide through the United Way of Central Indiana that offer free tax preparation to individuals and. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. How To Pay Estimated Taxes.

We last updated the. Select the Make a Payment link under the. Your browser appears to have cookies disabled.

If you have an account or would like to create one or if you.

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Learn More About Estimated Tax Form 1040 Es H R Block

State Tax Deadline Extended To May 17 Wthr Com

Indiana Estimated Tax Payment Form 2020 Fill And Sign Printable Template Online

Dor Completing An Indiana Tax Return

2021 Instructions For Schedule H 2021 Internal Revenue Service

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Dor Make Estimated Tax Payments Electronically

Estimated Quarterly Tax Payments 1040 Es Guide Dates

Quarterly Tax Calculator Calculate Estimated Taxes

How Estimated Taxes Work Safe Harbor Rule And Due Dates 2021

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Indiana Paycheck Calculator Smartasset

Dor Individual Income Tax Return Electronic Filing Options

Indiana Sales Tax On Cars What Should I Pay Indy Auto Man Indianapolis

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Form Urt 1 Fillable Current Year Indiana Utility Receipts Tax Return And Schedule Urt 2220