south dakota property tax rates by county

The second half of your real. Tripp County collects on average 13 of a propertys assessed fair market value as property tax.

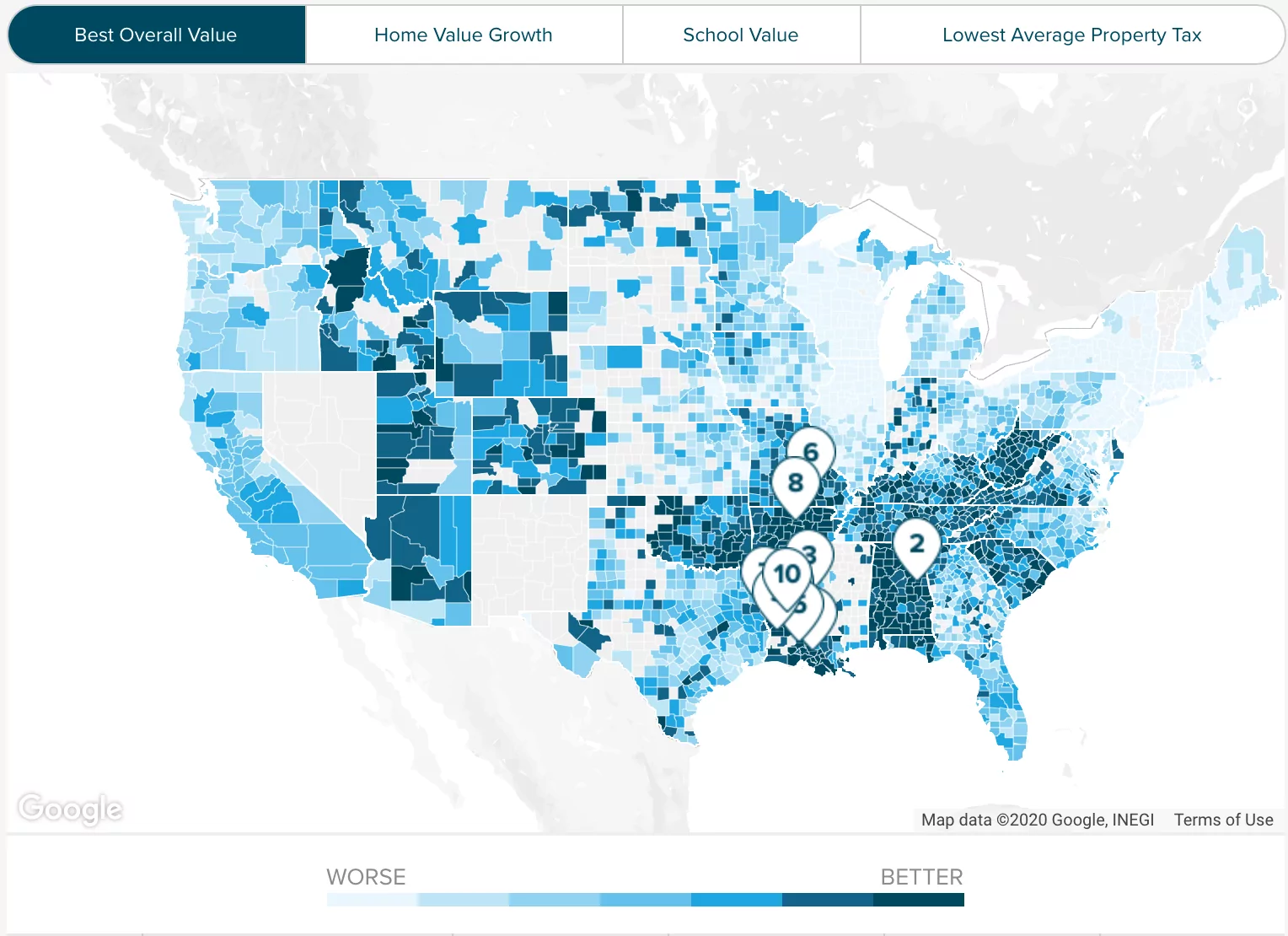

Property Taxes By State In 2022 A Complete Rundown

In the year 2020 property owners will be paying 2019 real estate taxes.

. The median property tax also known as real estate tax in Lincoln County is 247000 per year based on a median home value of 16970000 and a median effective property tax rate of 146 of property value. The first half of your real estate taxes are due by midnight on April 30th. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County.

The Turner County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Turner County and may establish the amount of tax due on that property based on the fair market value appraisal. You can use the South Dakota property tax map to the left to compare Bennett Countys property tax to other counties in South Dakota. Median property tax is 162000.

Appropriate communication of any rate hike is also a requisite. Pay Property Taxes Real estate taxes are paid one year in arrears. If you would like to pay your Property Tax by credit card we accept Discover Visa and Mastercard.

If a county falls below the 85 rule a factor above 10 may be applied. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised value and 4 be held taxable unless specially exempted. SDCL 10-24-1 Person can redeem property sold at sale at any time before tax deed is issued amount to.

To view all county data on one page see South Dakota property tax by county. Municipalities may impose a general municipal sales tax rate of up to 2. Lincoln County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax.

Redemption from Tax Sales. The median property tax also known as real estate tax in Jerauld County is 80500 per year based on a median home value of and a median effective property tax rate of 129 of property value. For more details about the property tax rates in any of South Dakotas counties choose the county from the interactive map or the list below.

The Turner County assessors office can help you with many of your property tax related issues including. Please call the Treasurers Office at 605 367-4211. To compare Codington County with property tax rates in other states see our map of.

Overview of South Dakota Taxes. Brookings County collects very high property taxes and is among the top 25 of counties in the United States ranked by property. Taxation of properties must.

You can look up your recent appraisal by filling out the form below. For additional information about your propertys. Elderly and disabled South Dakotans have until April 1 2022 to apply for property tax relief under South Dakotas Assessment Freeze for the Elderly and Disabled Program.

This interactive table ranks South Dakotas counties by median property tax in dollars percentage of home value and percentage of median income. Lincoln County collects the highest property tax in South Dakota levying an average of 247000 146 of median home value yearly in property taxes while Mellette County has the lowest property tax in the state collecting an average tax of 51000 102 of median home value per year. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85.

Lincoln County South Dakota. Across South Dakota the average effective property tax rate is 122. The states laws must be adhered to in the citys handling of taxation.

Jerauld County South Dakota. The median property tax in Tripp County South Dakota is 900 per year for a home worth the median value of 69400. Jerauld County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

The South Dakota Department of Revenue administers these taxes. Lincoln County collects the highest property tax in South Dakota levying an average of 247000 146 of median home value yearly in property taxes while Mellette County has the lowest property tax in the state collecting an average tax of 51000 102 of median home value per year. SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed including taxes interest penalties and additional costs incurred.

This surpasses both the national average of 107 and the. 53 rows On average homeowners pay 125 of their home value every year in property taxes or 1250 for. Real estate tax notices are mailed to the property owners in either late December or early January.

A home with a full and true value of 230000 has a taxable value 230000 multiplied by 85 of 195500. Then the property is equalized to 85 for property tax purposes. 33 rows South Dakota.

Under the program a qualifying homeowners property assessment is prevented from increasing for tax purposes. They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. The list is sorted by median property tax in dollars by default.

If the actual value of the home increases the homeowner. South Dakota laws require the property to be equalized to 85 for property tax purposes. The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments.

Convenience fees 235 and will appear on your credit card statement as a separate charge. The average yearly property tax paid by Tripp County residents amounts to about 191 of their yearly income. Brookings County South Dakota.

Lincoln County collects the highest property tax in South Dakota levying an average of 146 of median home value yearly in property taxes while Mellette County has the lowest property tax in the state collecting an average tax of 51000. If the county is at 100 fair market value the equalization factor is 085. Nonagricultural properties for each county.

If your taxes are delinquent you will not be able to pay online. The median property tax also known as real estate tax in Brookings County is 191300 per year based on a median home value of 13830000 and a median effective property tax rate of 138 of property value. Tax Rates Capacity Values.

The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128. To compare Haakon County with property tax rates in other states see our map of. As Percentage Of Income.

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Property Tax South Dakota Department Of Revenue

Thinking About Moving These States Have The Lowest Property Taxes

Property Tax South Dakota Department Of Revenue

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Tax Property

South Dakota Property Tax Calculator Smartasset

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

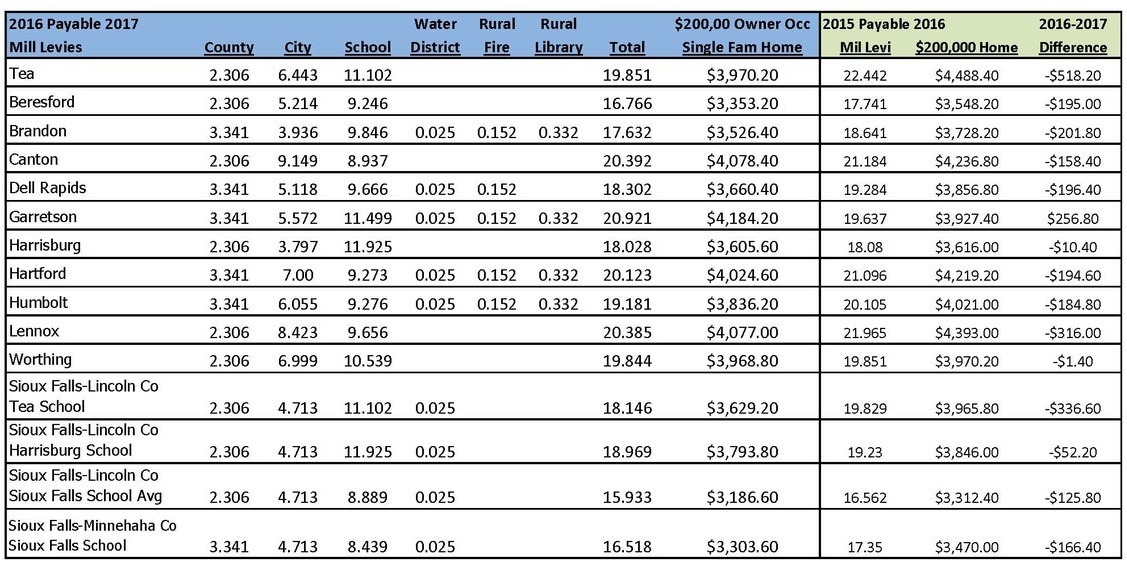

Tax Information In Tea South Dakota City Of Tea

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Taxes By State In 2022 A Complete Rundown

Mapped The Cost Of Health Insurance In Each Us State Travel Insurance Healthcare Costs Medical Insurance

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Dakota County Mn Property Tax Calculator Smartasset

Mapsontheweb Infographic Map Map Sales Tax

Tax Information In Tea South Dakota City Of Tea

Property Tax South Dakota Department Of Revenue

10 States With No Property Tax In 2020 Property Tax Property Investment Property